| BB&T Mortgage Rates and Calculator – Home Loans |

BB&T offers a range or mortgages and a free service of financial calculators to help choose the best one that is right for you. If you are seeking a mortgage loan or still in doubt whether buying or renting a property is the best option, find out the answer using the calculators.

Discover what home can you afford by entering the monthly and down payments that best applies to your economic situation

Click in the link (in the image caption) to be redirect straight to the calculator. After fill in with the required information as:

1 – Down payment

2 – Monthly payment

3 – Loan term (years)

4 – Interest rate

5 – Loan to value

6 – Yearly property tax

7 – Yearly property insurance

Now click on “See Your Results”

Use this calculator to learn how much your mortgage payments will be by typing :

- Loan amount

- Appraised value

- Loan term (years)

- Interest rate

- Yearly property tax

- Yearly property insurance

Find out your monthly payment for an adjustable-rate mortgage loan.

- Loan amount

- Appraised value

- Loan term (years)

- Yearly property tax

- Yearly property insurance

- State + federal tax rate

- Months before first adjustment

- Initial interest rate

- Months between rate adjustment

- Maximun rate adjustment

- Minimum rate

- Maximum rate

- Margin

- Index rate

- Months between index adjustment

- Index rate change (per adjustment)

Find out with this calculator the amount that you can borrow considering your income and debts.

Fill in with the required information as:

1 – Monthly Income

- Wages before taxes

- Investment income before taxes

- Income from rental properties

- Other income

2 – Monthly Payments (Include only loans that won’t be paid off in 10 months)

- Auto loans

- Student loans

- Rental property loans

- Other payments

3 – Other debts

- Monthly alimony, child support or other

- Credit card payment

4 – Loan Terms You Desire

- Interest rate

- Loan term (years)

- Down payment (% of price)

5 – Taxes and Insurance You Expect

- Yearly property tax

- Yearly property insurance

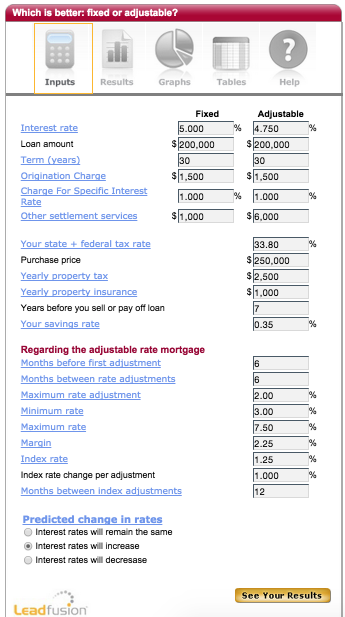

Enter the following:

- Interest Rate

- Loan Amount

- Term (Years)

- Origination Charge

- Charge for Specific Interest Rate

- Other Settlement Services

- Your State + Federal Tax Rate

- Purchase Price

- Yearly Property Tax

- Yearly Property Insurance

- Years Before You Sell or Pay Off Loan

- Your Savings Rate

Only fill-in the following about the Adjustable rate Mortgage

- Months Before First Adjustment

- Min. Rate

- Max. Rate

- Margin

- Index Rate

- Index Rate Change per Adjustment

- Predicted Change in Rates