BECU Auto Loan Rates and Calculator |

BECU offers vehicle loans in addition to calculators to help determine what the payment will be every month, how much the applicant can afford, loan comparison, and view which type of loan is best. After figuring the right situation for which the applicant qualifies they should submit their personal information, along with the vehicle information, to apply for an auto loan on the BECU website, by calling 1(800) 233-2328, or by going to a branch location.

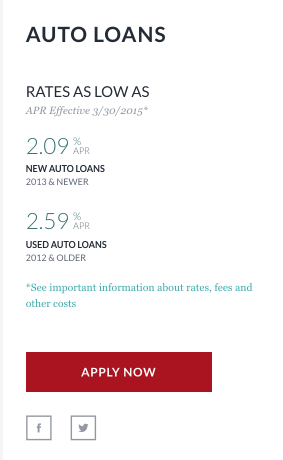

Auto Rates

The BECU auto loan rates may be figured out by going to This Page and viewing the rates on the left-side of the page.

Auto Loan Calculators

Enter the following information in order to compare different types of vehicles and their rates at which BECU will loan funds:

- Zip Code

- Vehicle Type – Automobile, Boat, Recreational Vehicle

- Type of Loan – New, Used, or Refinance

- Price of Vehicle

- Down Payment Amount

- Credit Rating – Latest that you are aware

Click on the “Continue” button and you will be given the rate of interest.

This type allows a user to see how much they may be able to pay for a vehicle based on their income and the type of loan they would like to make. The user must enter the following;

- Monthly Payment – The amount they would like to spend every month towards the auto.

- Down Payment – How much would the person like to pay at closing.

- Interest Rate – Use the default number for best results.

- Loan Term – Choose from 36, 48, 60, 72, or 84 months.

- Zip Code

- Make – If specific enter but if you have just started your car buying experience use the default of “All”.

If a user would like to compare loans and “play with the number” they may use this calculator to see how much their loan amount would be if they change the following variables;

- Down payment

- Purchase Price

- Loan Term (months)

- Interest Rate (as a percentage)

- Your Savings Interest Rate (if any)

- Your State & Federal Tax Rates (if any)

After entering the details of the two (2) loans the user may compare using the tools such as viewing

- Results – Monthly Payment and the Total Interest Paid

- View Graphs

- View Tables

This is the most simple of the tools which allows a person to enter generic factors that come into effect when creating a loan in order to get their monthly amount such as;

- Purchase Price

- Cash Rebate (if any)

- Value of Trade-in

- Amount Owed on Trade-in

- Down Payment

- Loan Term

- Interest Rate

Click the red button that says “Get Your Results” and the payment will be calculated and presented to you.

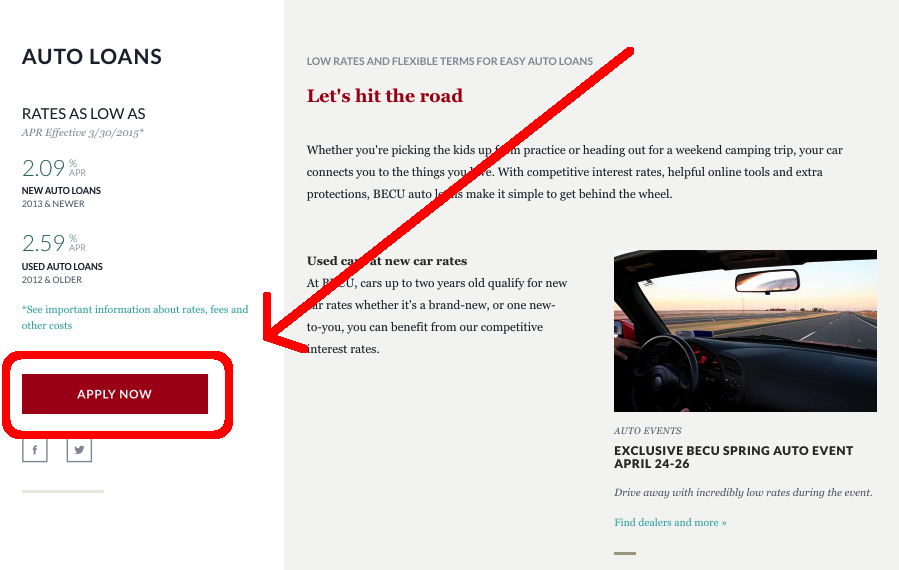

How to Apply

To apply for an auto loan online the applicant must;

Step 1 – Go to the BECU Auto Loan WebPage.

Step 2 – At this point you will be asked to either login to your account or register as a new user and apply for the vehicle loan. When applying it will be a four (4) part process; Personal Information, Account & Services, Fund Account, Confirmation.

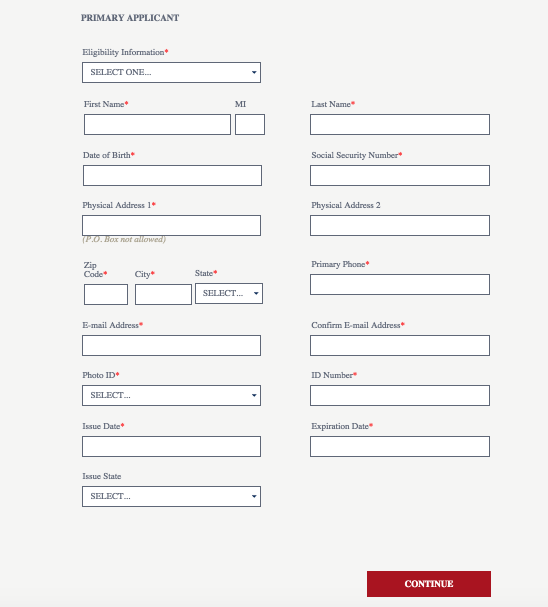

Auto Loan Application Steps

Step 3 – When filling out the application the following questions will be asked;

- Eligibility Information

- First Name

- Last Name

- Date of Birth (DOB)

- Social Security Number (SSN)

- Physical Address

- Zip Code, City, State

- Primary Phone

- E-Mail Address

- Photo Identification

- ID Number

- Issue Date

- Expiration Date

- Issue State

After this is complete click on the ‘Continue’ button on the bottom of the webpage.