BECU Mortgage Rates and Calculator – Home Loans |

BECU allows an individual to seek the mortgage rates for a home by entering their financial situation with the Loan Consultant Page. It provides a comprehensive breakdown of the applicant’s situation and suggests what might be the best option for obtaining a loan on a new home.

How to Find Rates

Step 1 – Go to Loan Consultant Page

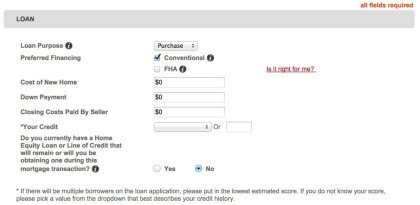

Step 2 – Enter the following personal information;

- Loan Purpose – Is it for a Purchase or a Refinance?

- Click on Conventional (Not insured by the federal government) or FHA (Not insured by the Federal Housing Administration and requires as little of a downpayment as 3.5% but the purchase price is restricted)

- Cost of New Home ($)

- Down Payment

- Closing Costs Paid by Seller

- Your Credit; Select from;

- Excellent

- Good

- Average

- Below Average

- Poor

- Or type in your Credit Score Number

- Answer the following question

Do you currently have a Home Equity Loan or Line of Credit that will remain or will you be obtaining one during this mortgage transaction?

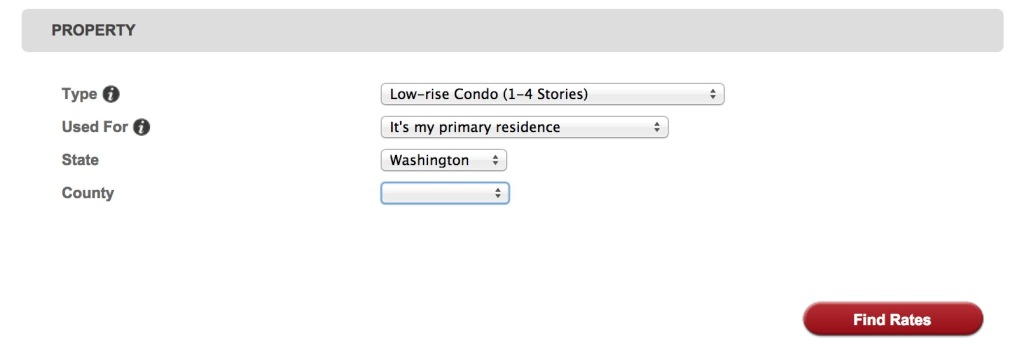

Step 3 – Enter the following property information;

- Type of Property;

- Single Family/Detached

- Attached/Townhouse

- Detached Condo

- High-rise Condo (5 or more stories)

- Land

- Low-rise Condo (1 to 4 stories)

- Manufactured Home (Double-wide)

- Manufactured Home in a Condo

- Manufactured Home Multi-wide

- Manufactured Home Single-wide

- Planned Unit Development

- Property is for the following use;

- My residence

- Second (2nd) residence/vacation home

- Investment home/rental property

- Located in the Following State (Only the following qualify);

- Arizona

- California

- Illinois

- Kansas

- Missouri

- Oregon

- Pennsylvania

- Washington State

- Select the County

Click on the Find Rates button on the bottom of the page and the rate will be shown on the next page.

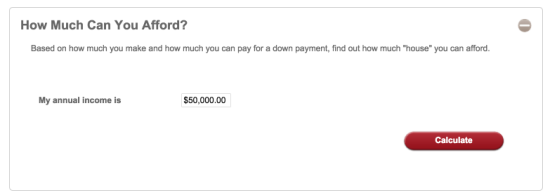

BECU Mortgage Calculators

This is determined by the amount of income the person makes per year and how much they are willing to pay for the down-payment.

Determines how much income the applicant needs to make in order to qualify for a home mortgage amount.

Determines how much the monthly payment will be after inputting the new home price and the down-payment percentage (%).

Calculates if the applicant should purchase the property or continue renting. The following must be entered

- Current Rental Payment

- Loan Payment

- Loan Term

- Interest rate (%)

- Annual Property Taxes

- Annual Homeowner’s Insurance

- Income Tax Rate

Input the applicant’s financial information in relation to the following variables;

- Loan Product

- Product Price

- Down Payment

- Monthly Income

- Monthly Debt Payments

- Balances on All Credit Cards

- State the Property is Located